Blog

- Adam Cheshire

- Vorensys partners with Yoti to offer best in class digital identity verfication

- Posted Tuesday 20 December, 2022

We're delighted to announce our new partnership with digital identity verification provider Yoti. Yoti is a recogised leader in the UK for digital identity verification services. Digital Identity Verification allows potential tenants to prove their identity online, via the Vorensys portal, using Yoti. Applicant's can scan a QR code, using their mobile device, during their online application. The Yoti mobile app then enables them to very quickly provide all of the information needed to accurately verify their identity. Details of the process, and a demo from the applicant's perspective, can be found here.

In the context of tenant referencing, digital identity verification is a powerful tool to speed up the identity verification process, right to rent checks and ultimately futher reduce the risk of fraud. Yoti checks the 'liveness' of the applicant to verify they're real and not a photograph. Photographs of approved identity documentation (e.g. Passport, Driving Licence, Residence Permit etc.) are then requested and, using the latest artificial intelligence technology, Yoti verifies the likeness of the applicant with the images on the documents provided and also verifies the authenticity of those documents.

The whole process typically takes less than five minutes.

When the applicant collects the keys to their property, their identity must then be verified against the photographs and documentation provided in the Vorensys report to ensure that the person collecting the keys is the person for which the reference has been prepared.

Digitial Identity Verficiation checks can be easily added to our standard referencing offers and is a very cost effective way to verify the identity of remote applicants that you may not meet in person until after the referencing process has been completed.

Please do not hesistate to contact us for further information on the service and pricing.

- Adam Cheshire

- Open Banking makes tenant referencing quicker and more accurate

- Posted Tuesday 10 December, 2022

The advent of Open banking has significantly transformed the way that tenant references are obtained and processed, making the process faster and more accurate than ever before.

Traditionally, the tenant referencing process can be time-consuming and laborious, as it involves manually gathering and verifying financial information from potential tenants. This can require the collecting and reviewing of bank statements, pay slips, and other financial documents, which takes a significant amount of time.

However, with the introduction of open banking, the tenant referencing process has been significantly streamlined. Open banking allows individuals and businesses to securely share their financial data with us. This means that, rather than having to manually gather and provide financial documents, tenants can simply grant permission for their financial institutions to securly share this information with Vorensys within a few seconds.

This is much faster and more efficient than traditional methods, as it reduces the need for manual processes and paperwork. It also helps to provide more accurate real-time data on income and expenditure, as the financial data is automatically verified and authenticated by the applicant's financial institution.

Overall, open banking has significantly sped up the tenant referencing process and provided more accurate real-time data on income and expenditure. This has made the process easier and more efficient for both landlords and tenants, and it has helped to reduce the risk of errors or fraud.

Open Banking is now an option for all Vorensys customers. If you don't already have it enabled on your account please contact us to get this added.

- Adam Cheshire

- UK Government confirms post brexit right to rent check requirements

- Posted Tuesday 29 May, 2019

The UK Government have finally confirmed their plans for right to rent checks for EU, EEA and Swiss citizens post Brexit.

In summary, nothing will change until 1 January 2021 at the earliest, regardless of whether the UK exits the EU with or without a deal. Full details can be found here

Here at Vorensy we'll continue to monitor progress and ensure that any updates required to our portal are made well ahead of any deadlines.

If you have questions related to right to rent, or any other aspects of our services, please do not hesistate to call or drop me an email.

- Mark Fairbrother

- Speeding up the tenant referencing process

- Posted Saturday 17 February, 2018

We're often asked by agents, landlords and tenants how they can speed up the tenant referencing process. Whilst our system is designed to capture as much pertinent information as possible from applicants up front, it's often difficult to predict exactly what documentation or additional information will be required to process each tenant reference at the start of the process. Our tenant guidance form provides details of exactly what we're likely to need based on the exact circumstances of the applicant. We strongly recommend that agents read this themselves and advise all prospective tenants to read it prior to filling out their tenant reference application forms. Uploading the required documents with an application can significantly reduce the amount of time it takes to process the reference.

Another common source of delays are the signed authorisations sometimes required by employers, landlords and accountants prior to releasing references to us. We strongly recommend that all applicants check with their landlords, employers or accountants what their specific policies are with regard to releasing references to third parties before submitting their application form. Signing the appropriate authorisation forms ahead of time ensures that once reference requests are received they can be turned around far more quickly. This is probably the most common source of delay for the tenant references we process.

Vorensys provide a free document management solution for all of our clients that allows them to securely store copies of any relevant documents should they be needed at any point during the tenancy. In order to ensure compliance with UK government 'right to rent' legislation, we strongly recommend that agents upload copies of the documents used to identify applicants, particularly those that are not UK, EU, EEA or Swiss nationals. Having immediate access to these documents means that our agents are able to quickly highlight any risks that may arise due to applicants not being eligible to reside in the UK for the duration of the proposed tenancy agreement.

Uploading copies of proof of income documentation is also strong advised as this helps our agents more rapidly determine whether the applicant meets the relevant affordability criteria. Prior to uploading we ask that any bank details (account code, sort codes, national insurance number etc.) are redacted to protect the privacy of the applicant.

Agents and applicants can also use our free online affordability calculator to determine affordability before moving ahead with their tenant reference application. If the gross income details submitted by the applicant don't meet the criteria there's a high likelihood that their application will fail. Additionally, if the applicant has several sources of income (e.g. a second job, dividends, universal credit etc.) we will need to see documentary evidence of this income so uploading this when requested will avoid the need for us to contact applicants later on in the referencing process.

Following these simple rules can drastically reduce turnaround times and ensure that applicants are able to move into their new homes as quickly as possible.

- Mark Fairbrother

- Anti Money Laundering

- Posted Saturday 10 February, 2018

The Anti-Money Laundering Directive, launched last year, requires all estate agents to carry out due diligence on both buyers and sellers; however, the government later clarified in their consultation outcome on Money Laundering Regulations 2017 that agents are not obliged to carry out mandatory AML checks on all landlords and tenants.

Section 6.2 of the 'Money Laundering Regulations 2017 Consultation Outcome' states:

“While it should be noted that the majority of respondents to the consultation supported the inclusion of letting agents within the regime, intelligence and evidence was not provided to justify the inclusion of lettings activity and the attendant costs of this proposal for those affected. The government will only 'gold plate' where there is good evidence that a material ML/TF risk exists. In line with the directive, lettings agents will continue to be within the scope of the regulations where they carry out estate agency work in accordance with section one of the Estate Agents Act 1979 (as amended). However, the application of the Money Laundering Regulations will not be extended to include lettings activity”

Despite AML checks not being a mandatory requirement, many agents are now choosing to do so for additional peace of mind. It's essential that all AML checks must be performed in strict compliance with relevant privacy laws. The General Data Protection Regulation (GDPR) directive, which replaces the 1998 Data Protection Act when it comes into force in May 2018, mandates even stricter controls over the storage, processing and collection of data. Agents that do not adhere to these strict controls when processing AML checks could very quickly find themselves on the wrong side of the law.

As a result of demand from our customers, we now offer optional AML checks as part of our standard tenant references for a small additional charge. Customers can choose to either run AML checks on all applications or select on a per application basis. Our partnership with Equifax ensures access to the most up to date and accurate data set in the UK. The checks will:

To benefit from these checks all you need to do is select ‘yes’ in the new AML section of our tenant reference application form. If you would like to include AML checks in all of your references, please call us to enable this feature on your account.

- Mark Fairbrother

- Autumn Statement.

- Posted Thursday 24 November, 2016

I’m sure, like us, you were somewhat surprised by the Chancellor of the Exchequer's announcement in yesterday’s Autumn Statement regarding the banning of letting agent fees. As you may already be aware, similar legislation has existed in Scotland for a number of years.

As a result of our strong customer base in Scotland, we are very well prepared for these changes and would like to draw your attention to a number of options that we already offer to our customers north of the border. Since Scottish law precludes agents from charging fees for references, we are already able to accept online payments directly from tenants and landlords. The process is very similar to the one you’re familiar with today, only tenants or landlords are sent a link to an online payment form prior to the reference application form being filled in.

During the online payment process, we make it clear to tenants and/or landlords that they are not obliged to purchase their tenant references from us, and that other providers exist, but we do guarantee that our tenant references meet or exceed the standards required by their letting agent. Our experience in Scotland is that upwards of 90% of tenants and landlords will purchase from us when we’re recommended by their letting agent.

We also offer agents the option to establish a full white label partnership allowing them to establish their 'own brand' referencing service.

We will be carefully monitoring the situation over the coming weeks and months to ensure we’re able to continue to offer you a compelling set of referencing products that make commercial sense whilst remaining fully compliant with the new legislation.

Please do not hesitate to give us a call if you'd like further details on the full range of tenant referncing options we're able to offer our customers.

- Mark Fairbrother

- Quack! We've Moved....

- Posted Monday 14 November, 2016

We've moved to new premises at Sugnall Business Centre in Staffordshire. Nestled in heart of the beautiful Staffordshire countryside, Sugnall estate has a long esteemed history and even gets a mention in the Domesday book back in 1086. More recently, it became the new home our expanding business. We've had another great year, growing the Vorensys tenant referencing team and forging new partnerships, and the old office was becoming a bit of a squeeze. As you'll see from the picture, Sugnall was a great choice with the outstanding scenery, local amenities and easy access to the M6. There's a coffee shop, walled garden and even a duck pond to keep the children amused on their visits. If you're in the area, why not stop by to say hello, grab a coffee or even feed the ducks!

- Mark Fairbrother

- New Web Site

- Posted April 5, 2016

Our old site has served us well, but it's time for a spring clean and a new lick of paint! Over the weekend we'll be moving to our brand new site. Besides a new 'look and feel' and new content, the new site will be a fully 'responsive design' using the Twitter Bootstrap framework allowing it to customise itself to fit the device you view it on. If you're viewing on a smart phone or tablet it will optimise itself to fit the size of your screen making it easier for you to view. We've also added new content and information abut our tenant reference products that we hope you'll find useful. Please let us know what you think, as always we value your feedback!

- Mark Fairbrother

- Right to Rent

- Posted January 15, 2016

If you're a landlord or letting agent in England you're more than likely aware that, as of the 1st of February this year, you'll be expected to perform 'right to rent' checks on all of your tenants. Failure to do so could result in fines of up to £3000. In order to help keep you on the right side of the law, we've launched our 'right to rent' tracking functionality that guides you through the process of performing the checks and recording the outcome. In addition, we've also launched our document management solution that allows you to store copies of the documents used to perform these checks. The government requires you to keep these for the duration of the tenancy and up to twelve months beyond. To find out more about performing right to rent checks either log into your Vorensys account or check out the government guidelines on gov.co.uk. In addition we've added a new 'right to rent' section to our tenant refernces to allow you to track the status of the applicant.

- Mark Fairbrother

- The Importance of Tenant Referencing

- Posted November 15, 2015

Over the last few years we have seen a rise in the demand for private rented accommodation. Obviously this is great news for landlords as having tenants in their properties means they can benefit from steady, on-going income. Although there may be a lot of interest in your property, it is essential to choose the right tenant. In this article we will explain the importance of tenant referencing when renting out properties. Tenant references are designed to help landlords and letting agents make a more informed decision on whether or not an individual will make a suitable tenant for their property. Tenant referencing involves checking whether an individual has an adverse credit history (unresolved bankruptcy, IVA etc.) and whether or not they have ever missed payments on previous rental properties. Landlords may carry out the referencing process by getting in touch with an individual's employer, previous landlord or letting agency. Many landlords outsource tenant referencing to third party companies for convenience.

Checking references can help landlords when it comes to the process of tenant screening. By screening the tenants, landlords will stand a better chance of selecting low risk individuals to move into their properties. Tenant vetting also involves checking that individuals have not breached previous tenancy agreements. If they have, then it is unlikely that you will want to form an agreement with them, as history could repeat itself.

By checking references you can also vet a potential tenant's financial situation. You need to make sure that they are going to be able to meet the monthly rent payments you require. Most letting agents recommend that an individual's gross salary works out to be more than two and a half times their share of rent. During the process you will also want to check that potential tenants are not still in arrears on previous tenancy agreements.

Finally, you will need to vet your tenants' personalities. If they have participated in anti-social behaviour or caused problems in their previous landlord's property, it will show up on their tenancy reference. You do not want to put yourself at risk of having damage done to your property, so make sure that your potential tenants have a clean record.

Better Safe Than Sorry

Whilst references are a great way to mitigate risk and ensure that potential tenants are the sort of people you want living in your property, legal expense and rent guarantee insurance provides a backstop in the unlikely event of a problem. Sometimes you may find that your tenant's circumstances change during their time in your property, which may lead them to being unable to pay their rent. Aside from losing out on monthly income, you may also have to consider the legal expense of evicting your tenant. Taking out a legal expense and rent guarantee insurance policy will free you from the worry of problem tenants. Not only will the policy help cover missed payments but it will also help cover any legal expense incurred, putting you in a better position to pursue legal proceedings.

- Mark Fairbrother

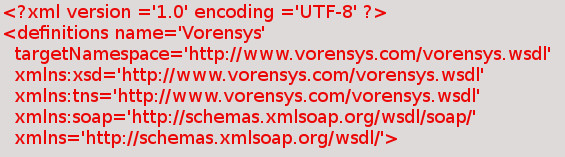

- SOAP API Update

- Posted February 5, 2014

You may recall that we introduced our SOAP API some time ago. This provides a programmatic interface for third parties (e.g. software vendors, property management sites etc.) to access our tenant referencing functionality. We've now enhanced this to provide access to additional portal functionality bringing it closer in line with what's available via our own portal. Software developers interested in using the API should email us at 'info@voensys.com' to obtain a developer key and documentation. As with other white label arrangements, we pay generous commissions to all applications generated via our SOAP API. If you're a user of the existing API no changes will be required to your existing code.